- Proof of Words

- Posts

- Bitcoin's on Sale & the Czech National Bank Buys BTC

Bitcoin's on Sale & the Czech National Bank Buys BTC

While Bitcoin dipped to a seven-month low, a European central bank has taken the opportunity to buy some BTC. The same seems to be happening with whales if you take a closer look at on-chain data.

TL;DR

The Czech National Bank creates a test portfolio of Bitcoin and digital assets.

While Bitcoin is on sale, whales use the time to accumulate, according to on-chain data.

The Czech National Bank Bought Some BTC 🇨🇿

It’s been a few months since I last wrote about the Czech National Bank, but we have an exciting update to that story.

On Thursday last week, the Czech central bank released a statement where it announced that it had bought a test portfolio of various digital assets and Bitcoin worth $1 million.

In addition to Bitcoin, the portfolio will include a test investment in an unnamed U.S. stablecoin and a tokenized deposit on the blockchain.

According to the statement, the purpose of the portfolio is to gain practical experience with holding digital assets and to implement and test the necessary related processes.

With that buy, the Czech National Bank has become the first central bank in Europe to hold Bitcoin directly, at a time when other European public institutions, like Luxembourg’s sovereign fund, are gaining exposure via Bitcoin ETFs.

I have to say the Czech National Bank is doing a great job here. They are actively buying and testing how to use digital assets, and they followed up their purchase by releasing a report that shows their research on why they are excited about Bitcoin.

The next steps for them are to assess how they will now hold all assets and how to integrate the new technology into their infrastructure.

Bitcoin Whales Utilize the Moment and Accumulate 🐋

As you can see in the title of today’s issue, Bitcoin is on sale.

At the time of writing, the price per Bitcoin is hovering at $91,000. While this is worrisome – we were just at $126,000 a little over a month ago – there are actually some positives to take away from this dip.

If you take a closer look at the Bitcoin blockchain (aka on-chain data), you’ll see the following picture:

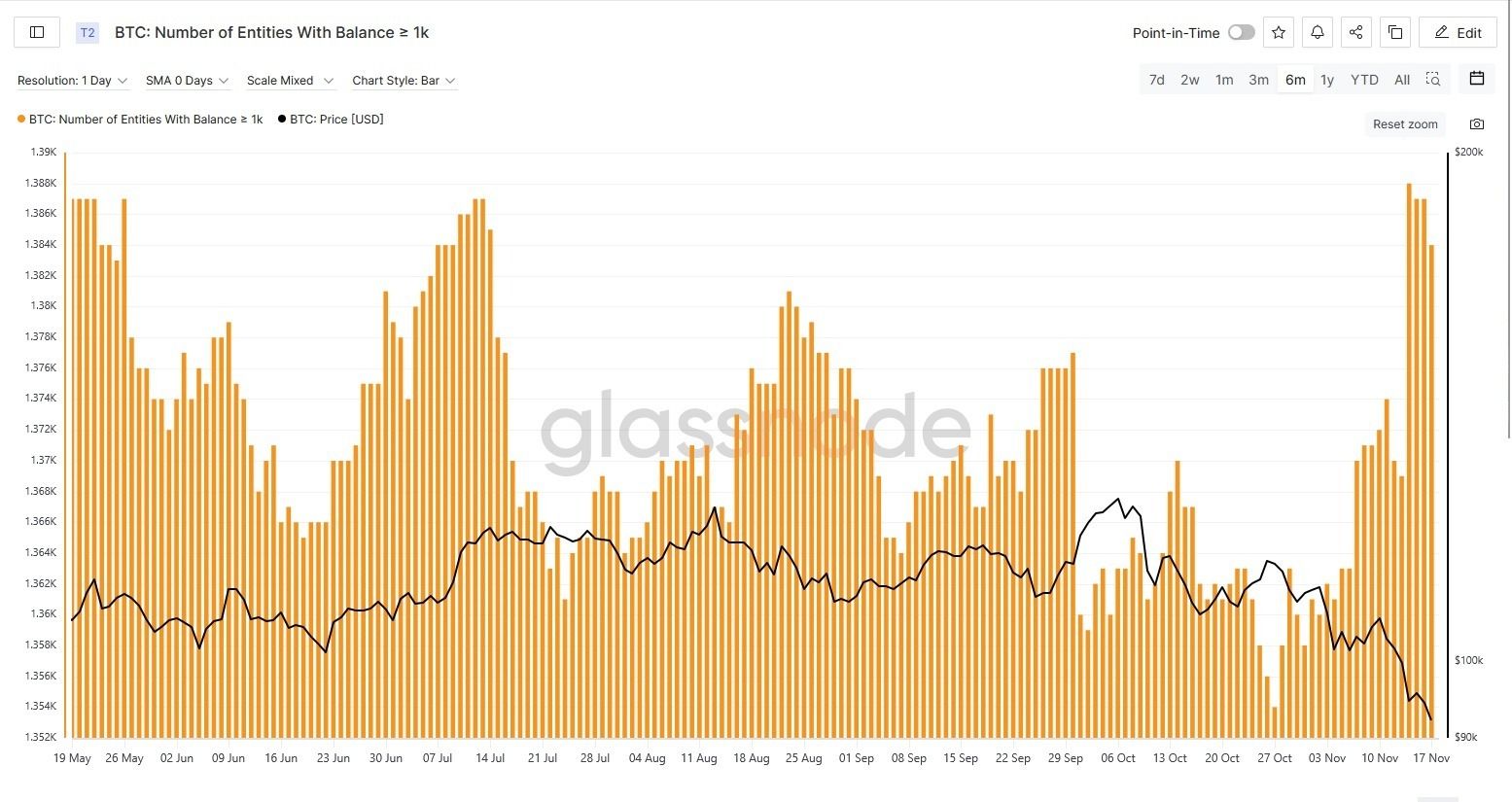

Source: Glassnode

The total amount of whale wallets (which are wallets holding above 1,000 BTC) dropped on October 27 to 1,354.

However, even though the price dipped to under $90,000 at one point, the number of whale wallets increased to 1,384, up 2% from levels we last saw over four months ago.

According to a comment by 10X Research's Markus Thielen in Cointelegraph, this runs counter to the current narrative that whales and OGs are constantly selling BTC.

There was significant selling by whales after the Federal Reserve's October 27 FOMC meeting, with a large chunk of Bitcoin sold in a short time.

But whale selling pressure could be subsiding if you look at other on-chain data sources.

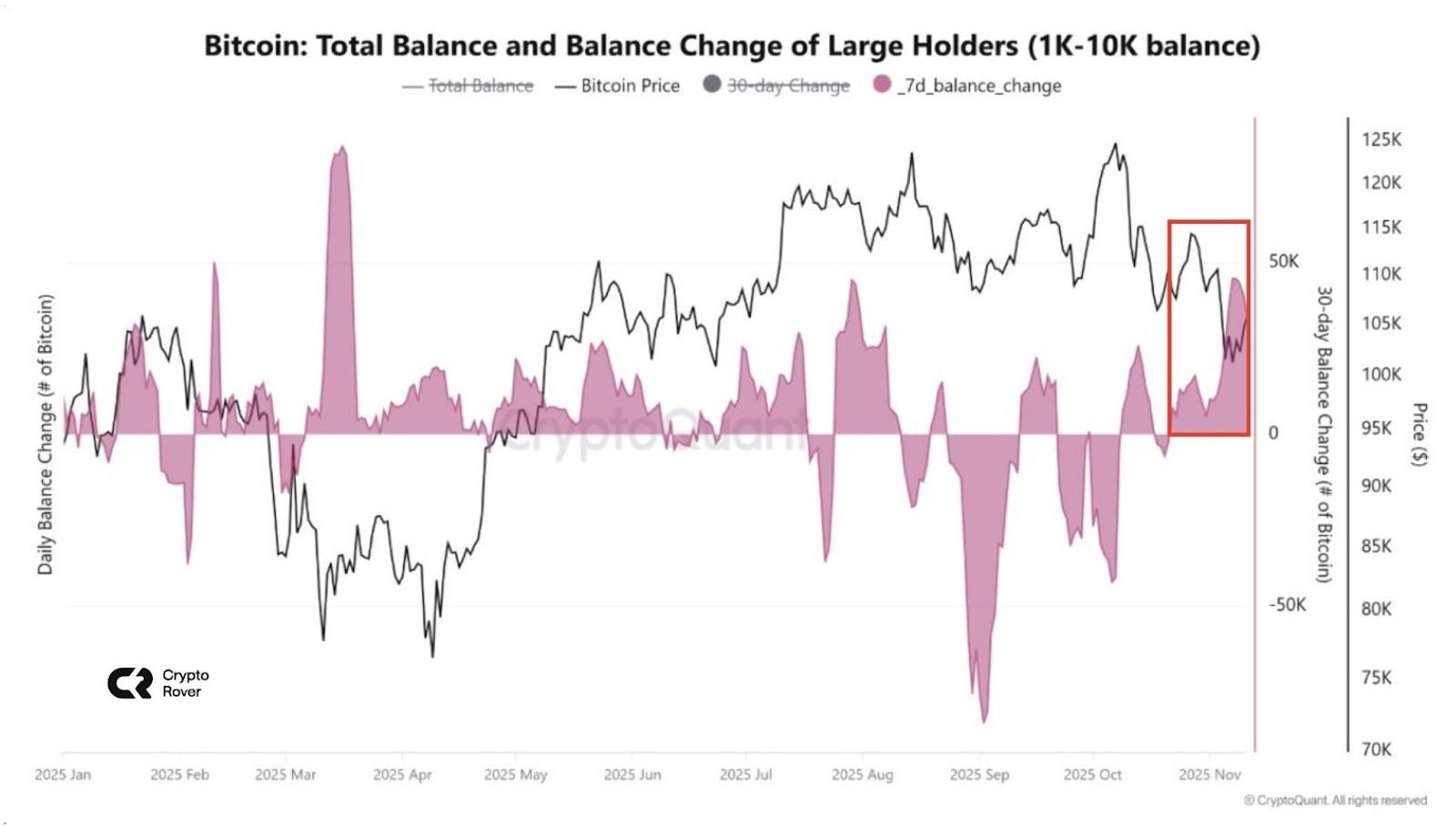

Source: X

According to data from Crypto Rover, Bitcoin holders with 1,000 to 10,000 BTC in their wallets are actually accumulating.

Since the first week of November, whales have actually accumulated at an accelerating pace.

This accumulation may not have been large enough to absorb the overall selling pressure from retail investors and panic sellers, but it’s interesting to see how whales have apparently been using the dip below $100,000 to buy more Bitcoin.

For now, we’ll need to wait and see how Bitcoin reacts and whether this dip was just a small correction or whether we’re experiencing a more significant change in market sentiment towards Bitcoin and digital assets.

Elsewhere in Bitcoin 📖

A quick look at what else has been happening in Bitcoin:

Your fellow stacker in sats,

Patrick Lowry

PS: Follow me on X for my daily takes on Bitcoin, freedom, and the pursuit of happiness.

Disclaimer: The opinions expressed in this newsletter are solely those of the author and do not necessarily represent the views of any associated company. This newsletter is for educational and informational purposes only and should not be construed as investment, financial, or any other professional advice. Investing in cryptocurrencies is highly speculative and carries a significant risk of substantial financial loss, so you must conduct your own thorough research and consult with independent professional advisors before making any decisions.