- Proof of Words

- Posts

- Bitcoin Hit a New All-Time High of Over $123,000

Bitcoin Hit a New All-Time High of Over $123,000

It happened again: Bitcoin reached a new all-time high.

If you thought the summer of 2025 was going to be a quiet one, you are in for a big surprise.

Bitcoin did its thing again, reaching yet another all-time high. This time around, it broke above $123,000 for the first time ever!

A positive net inflow streak for spot Bitcoin ETFs and the ongoing adoption of BTC as a treasury reserve asset were among the main drivers behind the recent price surge.

Also, I have some great news to share from Samara Asset Group: we received our first-ever issuer rating from Scope Rating!

It’s an exciting time, and we have a lot to talk about!

Bitcoin Breaks Above $123,000 for the First Time in History! 🚀

On July 14th, Bitcoin reached a new all-time high of just over $123,000.

If this is your first Bitcoin bull run, you will have had a great day. For those of us who’ve been in the game a while, this is business as usual… but it’s still a good feeling. 😁

Several factors contributed to BTC surpassing the $123,000 mark.

First off, spot Bitcoin ETFs are absolutely killing it right now, with an incredible bullish July so far.

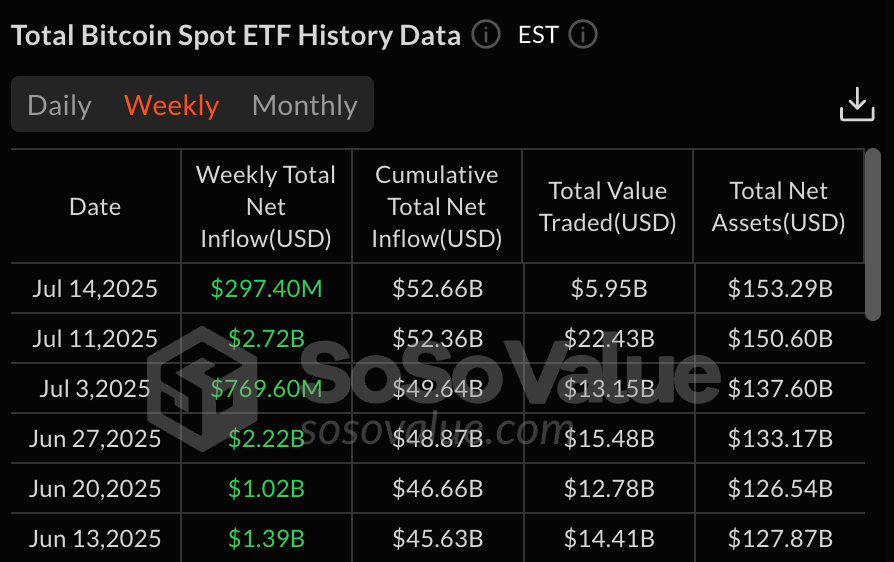

Source: SoSoValue

As shown in the graphic above, we’ve seen three consecutive weeks of net inflows into Spot Bitcoin ETFs. One week even saw over $2.7 billion net inflows!

ETF investors have been very bullish on Bitcoin lately, and this month, they’re feeling particularly optimistic.

The second reason is the ongoing interest in BTC as a treasury reserve asset for publicly traded companies.

The end of June and July so far have been a strong indicator that many more companies will likely adopt the ‘Bitcoin on balance sheet’ strategy.

The number of publicly traded companies that put Bitcoin on their balance sheets is increasing at a rapid rate! 🚀

— Samara Asset Group (@Samara_AG_)

5:28 AM • Jul 7, 2025

In fact, over 150 publicly traded companies hold BTC on their balance sheets.

That number more than doubled within a year, and the interest in BTC as a reserve asset continues to grow every day.

And it’s not just big companies or veterans such as Strategy who buy BTC, but also small market cap companies that follow the same playbook.

That interest, combined with the net inflows of spot Bitcoin ETFs, led to an incredible price rally, with over 16% in the green over the last 30 days (at the time of writing), and a new all-time high before the market corrected again.

Blackrock’s Spot Bitcoin ETF Surpasses $80 Billion in AUM in Record Time! 💪

BlackRock’s Bitcoin ETF is hella popular!

I wrote about its success of reaching $70 billion in assets under management (AUM) a month ago, and this month, they’re doing even better.

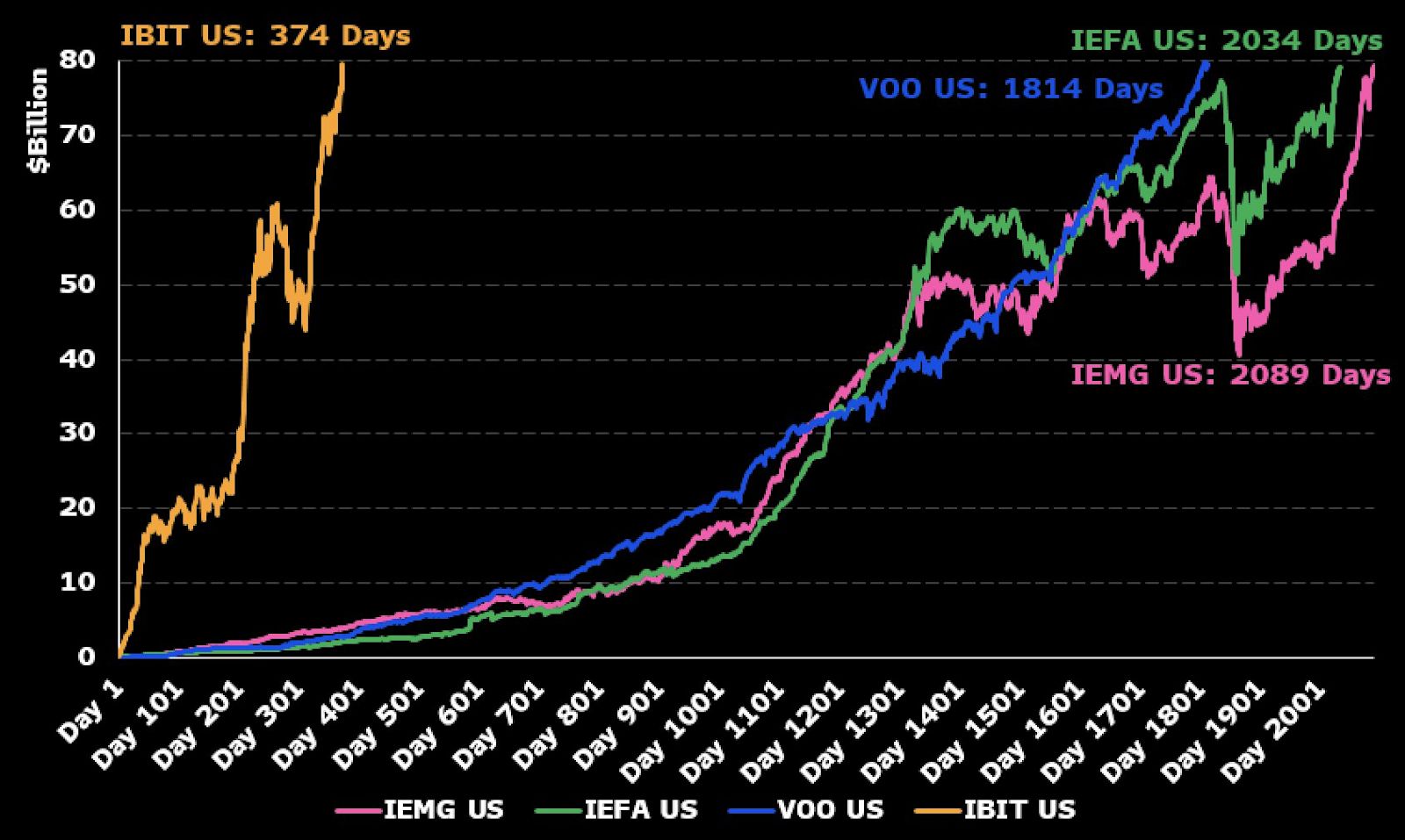

The IBIT-ETF has become the fastest ETF in history to reach over $80 billion in assets under management in just 374 days!

Source: Bitcoin Magazine

Comparing it to other funds, such as the Vanguard S&P 500 fund (VOO), which took 1,814 days, and the iShares Core MSCI EAFE ETF (IEFA US), which took 2,034 days, highlights just how much BlackRock’s Bitcoin ETF is outperforming.

BlackRock is also the first ETF issuer to hold over 714,000 BTC, making it one of the largest holders and, by far, the biggest institutional holder of Bitcoin.

What a time to be alive and witness the biggest monumental shift in finance! 💪

Samara Asset Group Receives First-Time Issuer Rating of “B-/Stable” From Scope Ratings 👀

Finally, I want to share an exciting update from Samara Asset Group.

We're excited to announce that we've received a first-time issuer rating of "B-/Stable" from Scope Ratings (@ScopeGroup_).

Scope has also assigned a first-time rating of B to our #Bitcoin Bond, which we issued in November 2024.

Learn more about our credit rating here. ⬇️

— Samara Asset Group (@Samara_AG_)

12:26 PM • Jul 14, 2025

We have received a first-time issuer rating of “B-”, which is classified as a “Stable” Credit Rating by the leading European Rating Agency, Scope Rating.

Further, Samara’s “Bitcoin Bond”, issued in November 2024, received an Instrument Credit Rating of “B”.

In their report, Scope Rating notes the positive rating drivers for Samara include:

A diversified portfolio by gross asset value, primarily across diverse technology-related funds.

20%-30% of liquid assets in the portfolio (Bitcoin and Northern Data), partially restricted by debt-related pledges.

A Low Loan-To-Value (LTV) providing notable headroom to covenants.

If you want to read the full report, you can do so on the Scope Ratings website.

I’m beyond excited! Not only does it serve as a strong signal to Samara shareholders, but it also showcases the strength of our balance sheet and the well-structured nature of our Bitcoin bond.

We intend to leverage the rating to continue servicing our existing debt, as well as explore new financing opportunities by tapping into the existing Bitcoin Bond and other avenues.

As always, I will keep you posted with new updates here on Proof of Words. 🚀

Your fellow stacker in Sats,

Patrick Lowry

Disclaimer: The opinions expressed in this newsletter are solely those of the author and do not necessarily represent the views of any associated company. This newsletter is for educational and informational purposes only and should not be construed as investment, financial, or any other professional advice. Investing in cryptocurrencies is highly speculative and carries a significant risk of substantial financial loss, so you must conduct your own thorough research and consult with independent professional advisors before making any decisions.